What Does Ach Processing Mean?

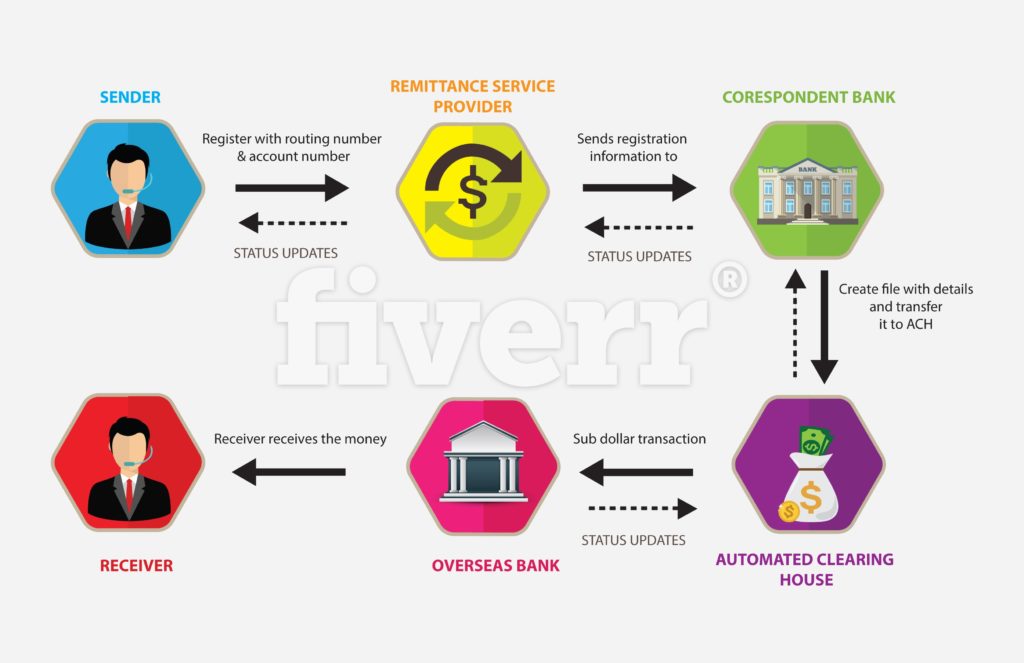

For many years, the world of financial has changed radically as well as has worldwide influenced numerous people. During this age of growth, as opposed to paying by cash, checks, credit or debit card, the payment procedure has evolved right into quicker, much safer as well as more effective electronic methods of transferring cash. Automated Clearing Up Home (ACH) has made this feasible.

There are 2 major categories for which both consumers and organizations make use of an ACH transfer. Straight settlements (ACH debit deals) Straight deposits (ACH credit score deals) Some financial institutions also use costs settlement, which enables users to arrange and pay all bills online using ACH transfers. Or you can use the network to start ACH deals in between individuals or vendors abroad.

An ACH settlement is made through the ACH network, instead than going through the major card networks like Visa or Mastercard.

Ach Processing Fundamentals Explained

An ACH debit deal does not involve physical paper checks or debit card. To start a deal with ACH, you'll require to authorize your biller, such as your electrical firm, to pull funds from your account.

You can likewise set up a link in between your biller and your financial institution account without authorizing automatic repayments. This offers you higher control of your account, permitting you to send repayment funds only when you specifically enable it.

It relocates cash from the employer's savings account to a worker's in a very easy as well as reasonably economical method. The company merely asks their banks (or payroll business) to advise the ACH network to pull cash from their account as well as deposit it appropriately. Likewise, ACH deposits allow people to start deposits elsewherebe that a bill repayment or a peer-to-peer transfer to a good friend or proprietor.

Indicators on Ach Processing You Need To Know

An ACH direct repayment delivers funds into a bank account as credit report. A straight deposit covers all kinds of down payment payments from organizations or federal government to a customer. This consists of federal government advantages, tax obligation and also various other reimbursements, as well as annuities and passion payments. When you get payments with straight deposit with ACH, the benefits consist of benefit, less fees, no paper checks, as well as much faster tax obligation reimbursements.

Photo source: The Equilibrium The number of debit or ACH credits processed annually is steadily increasing. In 2020, the ACH network refined financial transactions worth even more than $61. 9 trillion, a rise of nearly 11 percent from the previous year. These consisted of federal government, consumer, and also business-to-business deals, as well as worldwide repayments.

The 5. 3 billion B2B paymentsvalued at $50 trillionreflect a 20. 4% rise from 2020, as the pandemic fast-tracked businesses' button to ACH settlements. Over just the past two years, ACH B2B settlements are up 33. 2%. An ACH credit history involves ACH transfers where funds are pushed right into a checking account.

When somebody establishes up a repayments with their bank or credit scores union my explanation to pay expenses from their nominated bank account, these settlements would certainly be refined as ACH credit scores. ACH debit deals involve ACH transfers where funds are drawn from a checking account. That is, the payer, or consumer offers the payee consent to complete payments from their nominated financial institution hop over to these guys account whenever it ends up being due.

The Basic Principles Of Ach Processing

ACH as well as charge card settlements both enable you to take repeating payments simply and also conveniently. Nevertheless, there are 3 primary differences that it might be beneficial to highlight: the guarantee of settlement, automated cleaning house handling times, and also fees. When it comes to ACH vs. bank card, the most critical distinction is the guarantee of settlement.

Comments on “Excitement About Ach Processing”